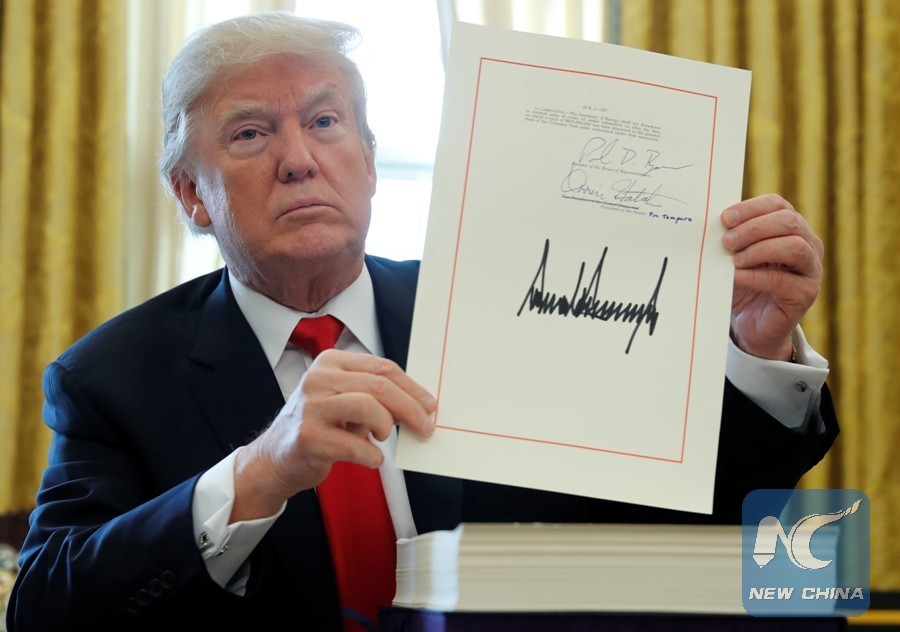

U.S. President Donald Trump displays his signature after signing the $1.5 trillion tax overhaul plan in the Oval Office of the White House in Washington DC on December 22, 2017. (REUTERS/Jonathan Ernst)

by Matthew Rusling

WASHINGTON, Dec. 31 (Xinhua) -- 2017 will be remembered as the year that U.S. President Donald Trump passed the biggest tax overhaul in three decades. And while the cuts aren't perfect, there are a number of benefits for corporations and individuals that will boost myriad sectors of the economy in 2018.

The new tax law "offers real tax relief" to people on all rungs of the economic ladder, Gene Panasenko, a veteran financial advisor in New York City who has appeared as an expert in various TV and print media, told Xinhua.

Trump has dominated the news this year like no other president in recent memory. Before wrapping up his first calendar year in office, the president passed a major tax overhaul -- the biggest change in the nation's tax system in three decades. He has claimed on various occasions that his plan, in addition to harnessing economic growth, gives incentives to U.S. corporations to return home.

Supporters say it will not only lift the economy and encourage investment in the United States, but will also boost markets and spur companies to create jobs, although others believe most of the benefits will go to those at the top of the income chain.

Panasenko noted that the tax law slashes the corporate rate from 35 percent to 21 percent, and that puts the United States back on track with other industrialized countries, giving companies incentive to remain stateside instead of packing their bags and seeking a better tax environment abroad.

Indeed, the United States previously had one of the world's highest levels of corporate taxation. While the United States is known worldwide as a good place to invest, given its deep financial markets, fair legal environment and educated workforce, many companies either left or avoided investing in the world's largest economy due to heavy taxation. Experts predict Trump's tax overhaul will change that.

Not only multi-billion dollar corporations will benefit, Panasenko said, noting that hundreds of thousands of small businesses will benefit from the tax revamp in a major way.

Some major corporations say they are giving employees bonuses as a result of the new law, and have made plans to generate more jobs, Panasenko noted.

Individuals in the middle class will also reap the benefits, he added, contending that the middle class will see the largest tax cut, a savings of up to 50 percent for some people, Panasenko said.

The tax overhaul is a "win-win" across the board, and all these "positive changes" will spark a chain reaction and have a positive impact on the economy, Panasenko said.

The new bill will bring back trillions of U.S. dollars from overseas, all of which will contribute to U.S. economic growth, he said.

Brookings Institution Senior Fellow Darrell West told Xinhua that while the new tax laws are favorable to companies and could spur more hiring, the new laws could in the long run widen the rich-poor gap.

The corporate tax environment is now more favorable in the United States, "so that very well could encourage companies to invest there and hire additional workers. That would be a big plus for the economy and would stimulate greater growth," he said.

There likely will be substantial differences sector to sector. Financial institutions fare well in the tax bill so that could be an area where there could be additional investment. Real estate did less well so that could be a sector that does not fare as well, West said.

The biggest plus of the bill is the substantial tax cut that is provided. "But most of the cut goes to corporations and wealthy individuals, so the average person is not going to see much of a reduction. If ordinary workers don't benefit, they will not be in a position to spend more money and stimulate greater economic growth," West said.

"In the long run, this tax cut will increase economic inequality. The rich will get richer, while the poor and middle class continue to struggle," he said.